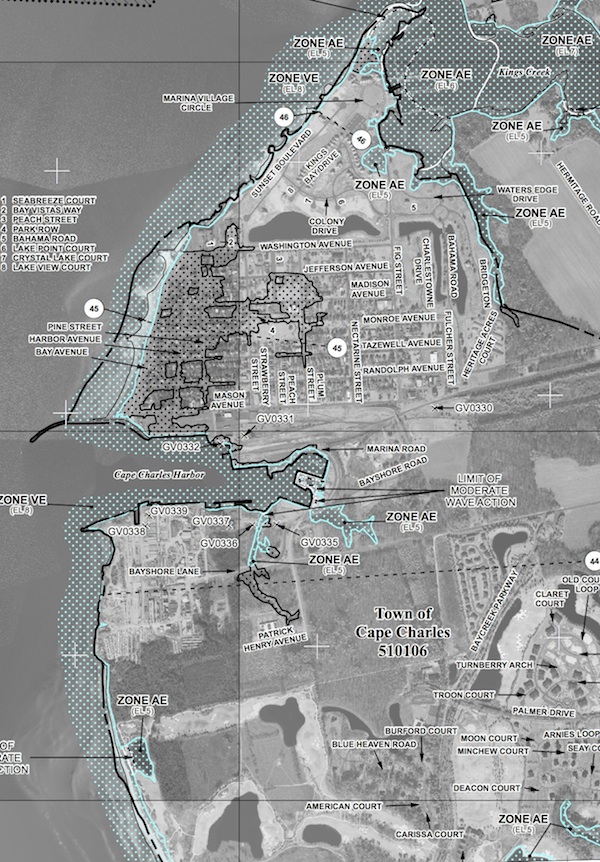

Click on map to view larger image. (An additional click may be required on larger image.) As proposed, only a few tiny areas in the entire Town of Cape Charles are classified ?AE,? which requires flood insurance to obtain a mortgage. On the current 2008 flood map (not shown), a majority of the Historic District is classified ?AE.?

By DORIE SOUTHERN

Cape Charles Wave

July 11, 2013

FEMA (Federal Emergency Management Agency) is proposing ?a drastic change regarding flood zones in Cape Charles.?

Town Planner Rob Testerman told the Cape Charles Planning Commission July 9 that a majority of the Historic District, currently rated high-risk by FEMA, is proposed to be reclassified at a much lower risk of flooding.

That is wonderful news to any property owner paying flood insurance premiums.

Under FEMA rules, federally regulated lenders require property owners to buy flood insurance in areas labeled ?A or ?V? on the FEMA flood zone map.

In high-risk areas, there is at least a 1 in 4 chance of flooding during a 30-year period.

In the current 2008 FEMA map, ?a majority of the historic portion of Cape Charles is located in the AE Zone,? Testerman said.

But the preliminary map for 2013 ?shows the AE zone ending at the beach,? he noted.

The most flood-prone area is of course the beach itself, which retains a ?VE? classification.

CONTINUED FROM FIRST PAGE

FEMA eventually will post the proposed maps on the Internet. Meanwhile, Testerman has copies for the Cape Charles area, and Northampton County Planner Peter Stith has maps for the County.

Although property in the moderate- to low-risk areas (which on the proposed map describes most of Cape Charles), is not required to have flood insurance, it is still recommended.

Flood insurance rates are markedly less in lower-risk areas.

Government-regulated flood insurance (Click here for rate charts)?for?$250,000 coverage in the ?A? zone has a minimum annual premium of $2,014.

But the same coverage in the lower-risk ?X? zone can cost as little as $412.

Although flood insurance is provided by private companies, the rates are regulated by FEMA.

The proposed maps are being reviewed for ?non-technical? errors such as street names. There will follow a 90-day appeal period, after which the new classifications and rates should be in effect.

Municipalities such as Cape Charles are allowed a further 6-month adoption period to amend flood zone ordinances.

Source: http://capecharleswave.com/2013/07/town-flood-insurance-costs-should-see-drastic-drop/

bank of america Yunel Escobar Eye Black Cruel Summer Endeavor shaun white carolina panthers Revolution TV Show

No comments:

Post a Comment

Note: Only a member of this blog may post a comment.